Pakistan’s real estate sector has long been perceived as one of the most lucrative areas of investment, offering Return on Investments (ROIs) of over 100% within a span of a few years – unheard of in any other country in the world. The reasons are quite simple.

Why bringing Pakistan’s real estate sector under the tax net is such a ‘taxing’ process

There has been almost no government oversight and minimal tax liabilities. As a result, speculative investors with substantial capital have benefited greatly, and for decades, were able to mint massive sums by buying premium real estate in bulk and then selling it a few years later at almost double the price. Added to this, considerable overseas investment in property was witnessed post 9/11, as Pakistani expatriates sought the security of having a home to come back to. This created artificial price hikes and a consequent demand-supply gap.

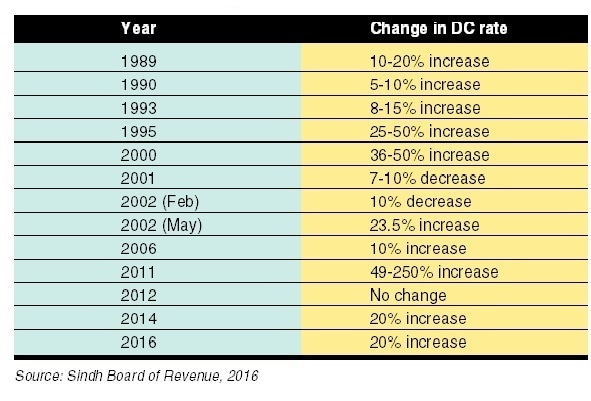

This scenario changed when the Federal Budget 2016-17 (announced in June last year) redefined the tax regime for the real estate sector. Since 1986, calculating the Collector Rate (the value of immovable property, referred to as the ‘DC rates’) was the prerogative of the District Commissioners (DC) of the Provincial Governments, who relied on fixed valuation tables to estimate the value of a property. This mechanism of valuation did not pose a problem until a gap began to emerge between the DC rates and market prices (see Table 1). The problem which then arose was that the DC rates did not reflect changes in the open market prices. For perspective, over the last 30 years, prices of vacant plots in DHA, Karachi have increased by more than 2,000 times. In 1980, a 2,000 square yard plot was valued at Rs 50,000 (Rs 25 per square yard). In 2015, the same plot was valued at Rs 100 million (Rs 50,000 per square yard).

As the difference between the DC rates and market prices widened, a black (undocumented) economy came into being; all real estate transactions were recorded as per the DC rates, while the actual sum of money exchanged between buyers and sellers was according to the market value. For example, when a 120-square yard plot with a DC rate of Rs 15,000 and a market value of Rs 50,000 was sold, the paperwork (title deeds and sales receipt) reflected the DC value, while the seller received Rs 50,000; a difference of Rs 35,000, became ‘black’ money. As a result, neither the Government of Pakistan, nor the income tax authorities, had any idea of the total income individual sellers and the real estate sector as a whole were generating.

Source: Sindh Board of Revenue, 2016

To correct this imbalance, Section 68 of the Income Tax Ordinance 2001 was amended through the Finance Act 2016, according to which Provincial Governments no longer had the authority to evaluate property prices. Instead, the Federal Board of Revenue (FBR) assumed the responsibility of determining property prices for documentation purposes, with the objective of bringing them at par with actual market values.

This increase in documented property values immediately created a slump in the market. According to most real estate agents, the volume of property transactions decreased by almost 85% post the Budget announcement.

The reason why property transactions severely dipped was due to the fact that all property taxes (introduced by FBR in 2014) increased significantly as the taxes were now calculated on the (substantially higher) FBR rates. Added to this, the FBR raised the tax percentage in the Federal Budget 2016-17, dealing a second blow to the real estate market. Firstly, the Capital Gain Tax (CGT) – essentially a tax on the profit a property owner generates from a sale – schedule was revised. Previously, five percent CGT was applicable on all properties purchased before July 1, 2016, and sold within three years. After the Budget announcement, properties purchased after July 1, 2016 were subject to the CGT schedule as per Table 2. Secondly, the Withholding Tax (WHT) – also known as Advance Tax – payable by buyers was doubled; two percent for income tax filers and four percent for non-filers. Until the 2016-17 Budget, this tax was only applicable on properties valued at three million rupees or more, but the FBR increased this slab to properties worth four million rupees or more.

The reaction from industry stakeholders was unanimous. Builders and developers threatened to stop all construction activity and real estate agents and consultants maintained that these changes would destroy the industry. As the property market came almost to a standstill and foreign direct investment and property tax revenues began to drop, the Government and FBR were forced to reconsider.

Related posts:

No related posts.